Valuation of Shares

Valuation of shares is the process of determining the fair value of the company shares. In this article we will talk about:

What is Share Valuation

Valuation of shares is the process of knowing the value of a company’s shares. Share valuation is done based on quantitative techniques and share value will vary depending on the market demand and supply. The share price of the listed companies which are traded publicly can be known easily. But w.r.t private companies whose shares are not publicly traded, valuation of shares is really important and challenging.

When is Valuation of shares required

Listed below are some of the instances where the valuation of shares is important:

- One of the important reason is when you are about to sell your business and you wanted to know your business value

- When you approach your bank for a loan based on shares as a security

- Merger, acquisition, reconstruction, amalgamation etc – valuation of shares is very important

- When your company shares are to be converted i.e. from preference to equity

- Valuation is required when implementing an employee stock ownership plan (ESOP)

- For tax assessments under the wealth tax or gift tax acts

- In case of litigation, where share valuation is legally required

- Shares held by an Investment company

- Compensating the shareholders, the company is nationalized

- Sometimes, even publicly traded shares have to be valued because the market quotation may not show the true picture or large blocks of shares are under transfer etc.

How to choose the share valuation method

There are various reasons for adopting a particular method for share valuation; it generally depends upon the purpose of valuation. Using a combination of methods generally provides a more reliable valuation. Let’s see under each approach what the main reason is:

- Assets Approach

If a company is a capital-intensive company and invested a large amount in capital assets or if the company has a large volume of capital work in progress then an asset-based approach can be used. This method is also applicable for valuing the shares during amalgamation, absorption or liquidation of companies.

- Income Approach

This approach has two different methods namely Discounted Cash Flow (DCF) or Price Earning Capacity (PEC) method. DCF method uses the projection of future cash flows to determine the fair value and if this data is reasonably available, DCF method can be used. PEC method uses historical earnings and if an entity is not in the business for a long time and just started its operations, then this method cannot be applied.

- Market Approach

Under this approach, the market value of the shares is considered for valuation. However, this approach is feasible only for listed companies whose share prices can be obtained in the open market. If there are a set of peer companies that are listed and engaged in a similar business, then such a company’s share public prices can also be used.

What are Methods of Share Valuation

There is no one valuation method that will fit any purpose, hence there are various methods of share valuation depending upon the purpose, data availability, nature and volume of the company etc.

- Asset-based

This approach on based on the value of the company’s assets and liabilities which includes intangible assets and contingent liabilities. This approach may be very useful to manufacturers, distributors etc where a huge volume of capital assets are used. This approach is also used as a reasonableness check to confirm the conclusions derived under the income or market approaches. Here, the company’s net assets value is divided by the number of shares to arrive at the value of each share. Following are some of the important points to be considered while valuing shares under this method:

All the asset base of the company including current assets and liabilities such as receivables, payables, provisions should be considered.

Fixed assets have to be considered at their realizable value.

Valuation of goodwill as a part of intangible assets is important

Even unrecorded assets and liabilities to be considered

The fictitious assets such as preliminary expenses, discount on issue of shares and debentures, accumulated losses etc. should be eliminated.

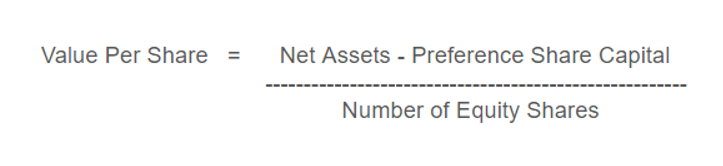

For determination of the net value of assets, deduct all the external liabilities from the total asset value of the company. The net value of assets so determined has to be divided by the number of equity shares for finding out the value of the share. The formula used is as follows:

Value per share = (Net Assets – Preference Share Capital) / (No. of Equity Shares)

- Income-based

This approach is used when the valuation is done for a small number of shares. Here, the focus is on the expected benefits from the business investment i.e what the business generates in the future. A common method used is the estimate of a business’s value by dividing its expected earnings by a capitalization rate. There are two other methods used such as DCF and PEC. PEC can be used by an established entity and newly started business or companies with volatile short-term earnings expectations can use the more complex analysis such as discounted cash flow analysis. Value per share is calculated on the basis of the profit of the company available for distribution. This profit can be determined by deducting reserves and taxes from net profit. Listed below are the steps to determine the value per share under the income-based approach:

Obtain the company’s profit (available for dividend)

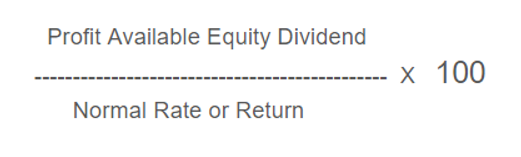

Obtain the capitalized value data

Calculate the share value ( Capitalized value/ Number of shares)

Note: Capitalized Value is calculated as follows:

Market-based

The market-based approach generally uses the share prices of comparable public traded companies and the asset or stock sales of comparable private companies. Data related to private companies can be obtained from various proprietary databases available in the market. What is more important is how to choose the comparable companies – a lot of pre-conditions to be kept in mind while selecting such as nature and volume of the business, industry, size, financial condition of the comparable companies, the transaction date etc. There are two different methods when using the yield method (Yield is expected rate of return on investment) they are explained below:

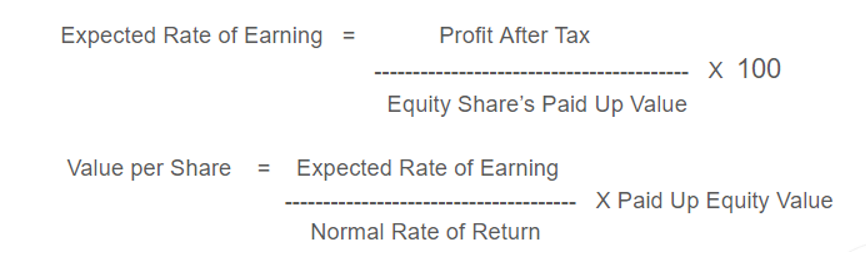

- Earning Yield

Shares are valued on the basis of expected earning and the normal rate of return. Under this method, value per share is calculated using the below formula:

2. Dividend Yield

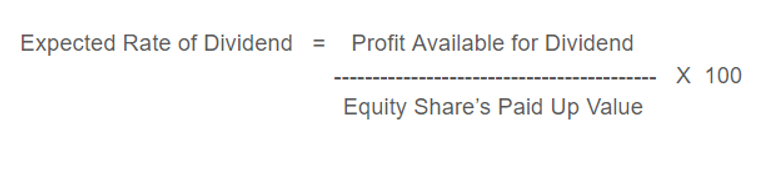

Under this method, shares are valued on the basis of the expected dividend and the normal rate of return. The value per share is calculated by applying the following formula:

Expected rate of dividend = (profit available for dividend/paid-up equity share capital) X 100